/macOSSierraMail-5786b68a5f9b5831b53803c2.jpg)

Mac OS X – – ShareFreeAll.com. Clean, optimize, and maintain your Mac with the all-new CleanMyMac. CleanMyMac lets you safely and intelligently scan and clean. Share is a simple web server that makes your information available wherever you can connect to the internet. Sharing files is simple and easy. You can make and edit notes. You can also listen to.

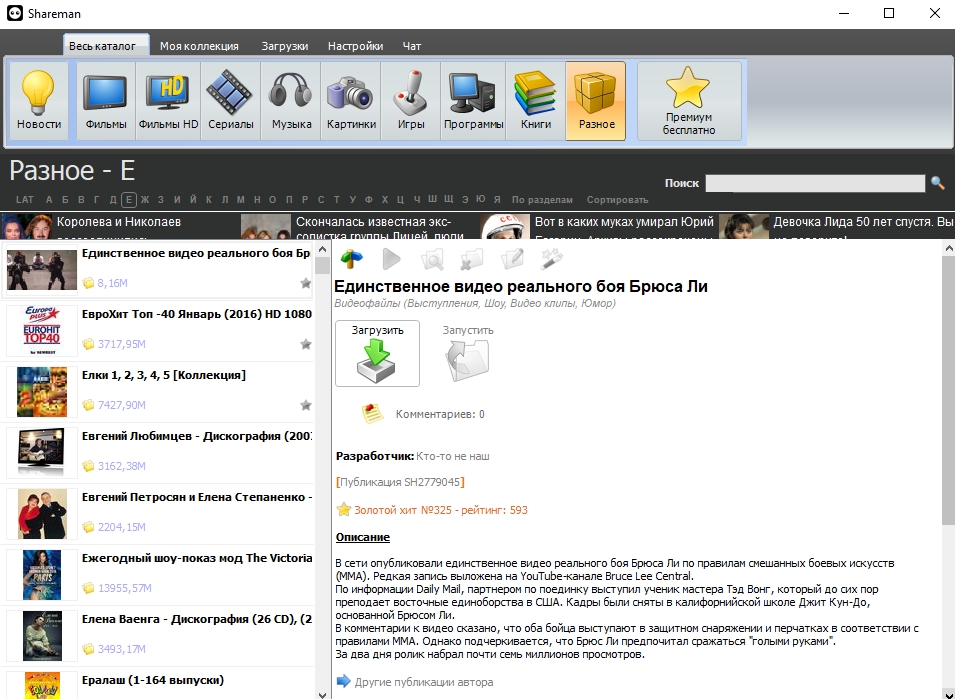

Shareman For Mac Os Versions

This sheet contains the current details of common general questions asked of ourReceptionist and Help Desk. It is regularly updated so as it reflects the current status. |

Last Update 13 Check Version Numbers Fax Number For those who still wish to use fax, note that Trimar has recently changed its fax number. It is now (02) 9440 8249. This will be phased out shortly as we hardly receive any faxes as email is the preferred form of communicating.

If you do not have Payman and require information about it and STP, please feel free to contact us. Phase 2 of STP has been specified by the ATO and Payman has been updated to be ready for it, when the ATO decide to enable it. Several new balances have been incorporated to cater for the extended range of information that the ATO will require. How to Start Using STP The Gateway usage fees are (for each ABN being processed), based on number of employees - PRINTER SELECTION WITHIN TRIMAR Trimar on Apple Computers CASHMAN – within CASHMAN refer to Help/Contents/Year End Instructions PAYMAN – refer to Help/Help Contents/Year End Instructions (includes Payment Summaries). DEBTORS/CREDITORS – no year end procedure – change aging date as normal.SHAREMAN – refer to Help/Help Contents/Search/Year End Instructions. ASSETMAN – balance forward using New Year option. (for Assetman, these dates can be edited backwards and forwards without effecting the data). FRINGEPAC - does not require balance forward, but you should check that you have updated the correct year start date, FBT tax rate and benchmark interest rate for the current year. Vehicle closing odometer readings can be rolled forward if required or manually adjusted at your discretion. NEW PROGRAM RELEASES Eligible clients clients (who are under maintenance) will be able to download the latest versions of our Windows software products directly from the “Client Services” area of our website. To do this, you must be registered with us and have obtained the appropriate passwords. Please e-mail us if you do not know your passwords. Brochures For Trimar Products LEASEMAN V6.10 o Complete rewrite and compatible with Windows 7 and 64 bit operating systems o Currently selected printer displayed on all report screens o New Payment Summary Report o The ability to email self opening zipped data files o The ability to have either HP or Lease ledger set up o The number of Lease Classifications has been increased to 20. Data accessed with this update can no longer be accessed using earlier versions of Leaseman o Fix for possible Printer selection problem under Terminal Server o Ability to select a temporary printer and save an Application default Printer o Screen resizing enabled o The ability to move groups or selected entities from one location to another o You can now enter a fractional useful life: eg 5.5 years o Dates can now be entered via a PopUp Calendar o Fix Arrears calculation for structured leases and correct schedule o Changes to restore Entity o Small changes Structured Payments calculcation o Updates to email module o Ability to save backup device details ASSETMAN V3.30 o Complete rewrite and compatible with Windows 7 and 64 bit operating systems o Currently selected printer displayed on all report screens o Displayed Screen reports can be easily resized o Option to use HTML HELP or WinHELP o Serial Number Report added o Improved Backup to CD option o The ability to email self opening zipped data files o Fix for possible Printer selection problem under Terminal Server o Ability to select a temporary printer and save an Application default Printer o Screen resizing enabled o The ability to move groups or selected entities from one location to another o Fix 'Invalid Date' hanging in Add/Edit asset o Dates can now be entered via a PopUp Calendar o Updates to email module o Export facility improved and extended o Ability to save backup device details

o Complete rewrite and compatible with Windows 7 and 64 bit operating systems o Benchmark Interest rate 5.25% for 01/04/2017 o Fix rounding and FBT Return report o Changes to restore Entity o Updates to email module o Benchmark Interest rate 5.37% for 01/04/2020 o 2018/2019 Benchmark Interest 5.2% added o 2019/2020 Benchmark Interest 5.37% added and is now editable for current year.o Ability to save backup device details FINMAN V20.02 o Ability to save and restore Division 7 calculation details o New effective interest rate calculation o Split variable interest rate loans o Daily interest schedules if required o Currently selected printer displayed on all report screens o Displayed Screen reports can be easily resized o Additions to GST facilty in Lease and Hire Purchase o Option to include all GST in payment 1 for HP Loan o 2016 Div 7 Interest rate o Option to use HTML HELP or WinHELP o Changes to HP Schedule for GST reporting o Fix for possible Printer selection problem under Terminal Server o Ability to select a temporary printer and save an Application default Printer o Screen resizing enabled o Minor bug fixes o Final PAYG Tax tables for the year started 1st July, 2018 o New Lease/HP Calculation option for Variable payments (Structured) o Fix for mistake made by ATO when they issued SFSS and HELP tables for weekly pays between $1587 and $1681 for 2017 year o Dates can now be entered via a PopUp Calendar o 2017/2018 Benchmark Interest 5.3% added o Save and retrieve Loan calculations added to Finman o Fixes for Structured Payments o Updates to email module o An update to Variable Loan calculation to enable changes to the loan to be entered and the balance calculated - this adds another column to data entry. o Tax tables for 2020/2021 included o 4.52% for 2021 Div7 Interest rate o Budget 2020 Tax table chnages for JobKeeper o Complete rewrite and compatible with Windows 7 and 64 bit operating systems o Currently selected printer displayed on all report screens o Displayed Screen reports can be easily resized o Flood Levy for 2012 (no longer required) o Option to use HTML HELP or WinHELP o $445 limit for Low Income rebate from 2013 o Abillity to remove page breaks between reports o Fix for possible Printer selection problem under Terminal Server o Ability to select a temporary printer and save an Application default Printer o Screen resizing enabled o 2% Budget Levy for incomes >$180,000 in 2015 o Contains the tax tables for 2016/2017. o Fixed error in Minor tax calculation o Updates to email module o Updates for 2018/2019 o Remove Spouse rebate after 2014 year o LMITO Rebate o $1080 Low Income Rebate for 2018/2019 o Include a line for total rebates in Total tax preview on data entry screen o Change in HECS/HELP for 2020 and 2021 year o Tax table changes for 2020 Budget relief SHAREMAN V7.55 o Updates to email module o Remove the clicking noise during data entry when ENTER pressed o Check dividend tax rate in range during data entry o 30th June 2020 Market value file mv300620 o change to dividend ausit report to include trust/foreign income o Ability to save backup device details

Recent Changes o Import Facility added o Updates for year ending 30th June 2020 o Cosmetic changes to clarify STP procedures o WPN allowed for STP o Changes to Wording for STP and After the Fact Data Entry Menu o Separation of Missing and Alerts in STP o Third option for calculating W1 and W2 options in STP o Miscellaneous improvements and updates o Tax tables for 2020/2021 included o Major changes in anticipation of STP Phase 2. The new STP has extended the amount of information to be gathered and this has required many changes within Payman. As it stands, Payman caters for STP phase 1, but is data ready for phase 2. o Increased error checking for STP o Moved STP menu from Other Functions to Top Menu o Moved STP Summary Report to STP Menu and allowed for Finalise Status per employee o Fixed error setting up TPAR Client o Employer Super Payments can now be made via API to SuperChoice Clearing House o Super USI codes can be verified before processing SuperStream o Minor enhancements o Ability to save backup device details o Budget 2020 Tax table chnages for JobKeeper

o Updates to email module

|

| CURRENT PROGRAM VERSIONS The versions below represent the software release that is currently available from this web site (Client Services). Access to client services via password. All clients who have paid maintenance are provided with the current password. Current Software Versions Program Version Date of Last Update Assetman32 3.30 10/09/2020 Fringepac32 4.35 10/09/2020 Leaseman32 6.10 10/09/2019 Payman32 20.08 13/10/2020 Shareman32 7.55 10/09/2020 Taxman32 24.02 10/10/2020 Finman32 20.02 13/10/2020 Frankpac32 2.14 22/12/2019 Fileman 1.03 22/12/2019 Cashlink 1.09 22/12/2019 Cashman32 7.50 06/08/2016 PROGRAM CURRENT MAINTENANCE (2019/2020) SUPPORT SUBSCRIPTION (inc GST) SHAREMAN $110 LEASEMAN $110 ASSETMAN $110 TAXMAN $150 PAYMAN $220 CASHMAN $110 FRINGEPAC $110 FRANKPAC $110 FINMAN $ 99 Our update policy is to issue email notification of releases when ever the need dictates a program change is necessary to ensure proper operation of the software or Government legislation changes (eg tax rates). In general, all registered users are encouraged to download updates from the Client Services section of our web site when they note that the version number has changed. We always ensure that updates are not disruptive to normal program operation and if a data restructure is required, it will be automatic and you will always be alerted. |

Shareman For Mac Os 10.13